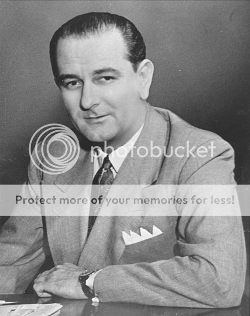

President Lyndon B. Johnson in the 1950s as a US Senator

Every election cycle, Secular Americans have to endure slimy pandering to the religious right by candidates looking to get elected to office. Some on the right of the political spectrum want to see the Johnson Amendment repealed so that churches are free to be involved in politics as much as they want. As it stands now, promises for repealing the law is pandering because it is hardly enforced and it can’t get a repeal vote now in a Congress with a Republican majority.

The Johnson Amendment refers to a change in the US Tax code passed in 1954. It was introduced by then Senator Lyndon B. Johnson and some have said he did it to silence some opponents to his reelection to the Senate.